![]() June 2018

Green Bond Principles

June 2018

Green Bond Principles

Introduction

The Green Bond market aims to enable and develop the key role that debt markets can play in funding

projects that contribute to environmental sustainability. The Green Bond Principles (GBP) promote

integrity in the Green Bond market through guidelines that recommend transparency, disclosure and

reporting. They are intended for use

by market participants and are designed to drive the provision of information needed to increase

capital allocation to such projects. With a focus on the use of proceeds, the GBP aim to support

issuers in transitioning their business model towards greater environmental sustainability through

specific projects.

Issuance aligned to the GBP should provide an investment opportunity with ransparent green credentials. By recommending that issuers report on the use of Green Bond proceeds, the GBP promote a step change in transparency that facilitates the tracking of funds into environmental projects, while simultaneously aiming to improve insight into their estimated impact.

The GBP provide high level categories for eligible Green Projects in recognition of the diversity

of current views and of the ongoing development in the understanding of environmental issues and

consequences, while liaising when needed with other parties that provide complementary definitions,

standards and taxonomies for determining

the environmental sustainability of projects. The GBP encourage all participants in

the market to use this foundation to develop their own robust practices, referencing a broad set of

complementary criteria as relevant.

The GBP are collaborative and consultative in nature based on the contributions of Members and Observers of the Green Bond Principles and Social Bond Principles (referred to as the Principles), and of the wider community of stakeholders. The Principles are coordinated by the Executive Committee. They are updated typically once a year in order to reflect the development and growth of the global Green Bond market.

The 2018 Edition of the GBP

This edition of the GBP benefits from the feedback of the Autumn 2017 consultation of the Members and Observers of the Principles, as well as from the input of the working groups coordinated by the Executive Committee with the support of the Secretariat.

The 2018 edition of the GBP remains framed by four core components (Use of Proceeds, Process for

Project Evaluation and Selection, Management of Proceeds and Reporting), as well as recommendations

for the use of external reviews. It mirrors the additional guidance and updated definitions for

external reviews that is contained in

the separately released “Guidelines for Green, Social and Sustainability Bond External Reviews” which was drafted in close cooperation with external reviewers. It refers to eligible

Project categories contributing to five high level environmental objectives (climate change

mitigation, climate change adaptation, natural resource conservation, biodiversity conservation,

and pollution prevention and control) rather than four key areas of concern as previously. It notes

that international and national initiatives to produce taxonomies may give further guidance to

Green Bond issuers. Timely reporting

of material developments is also highlighted in the revised text.

Green Bonds are any type of bond instrument where the proceeds will be exclusively applied to

finance or re-finance, in part or in full, new and/or existing eligible Green Projects (see section

1 Use of Proceeds) and which are aligned with the four core components of the GBP.

Different types of Green Bonds exist in the market. These are described in Appendix I.

It is understood that certain Green Projects may have social co-benefits, and that the classification of a use of proceeds bond as a Green Bond should be determined by the issuer based on its primary objectives for the underlying projects. (Bonds that intentionally mix Green and Social Projects are referred to as Sustainability Bonds, and specific guidance for these is provided separately in the Sustainability Bond Guidelines).

It is important to note that Green Bonds should not be considered fungible with bonds that are not aligned with the four core components of the GBP.

The Green Bond Principles (GBP) are voluntary process guidelines that recommend transparency and disclosure and promote integrity in the development of the Green Bond market by clarifying the approach for issuance of a Green Bond. The GBP are intended for broad use by the market: they provide issuers with guidance on the key components involved in launching a credible Green Bond; they aid investors by promoting availability of information necessary to evaluate the environmental impact of their Green Bond investments; and they assist underwriters by moving the market towards expected disclosures that will facilitate transactions.

The GBP recommend a clear process and disclosure for issuers, which investors, banks, underwriters, placement agents and others may use to understand the characteristics of any given Green Bond. The GBP emphasise the required transparency, accuracy and integrity of information that will be disclosed and reported by issuers to stakeholders.

The GBP have four core components:

1. Use of Proceeds

2. Process for Project Evaluation and Selection

3. Management of Proceeds

4. Reporting

1. Use of Proceeds

The cornerstone of a Green Bond is the utilisation of the proceeds of the bond for Green Projects, which should be appropriately described in the legal documentation for the security. All designated Green Projects should provide clear environmental benefits, which will be assessed and, where feasible, quantified by the issuer.

In the event that all or a proportion of the proceeds are or may be used for refinancing, it is recommended that issuers provide an estimate of the share of financing vs. re-financing, and where appropriate, also clarify which investments or project portfolios may be refinanced, and, to the extent relevant, the expected look-back period for refinanced Green Projects.

The GBP explicitly recognise several broad categories of eligibility for Green Projects, which contribute to environmental objectives such as: climate change mitigation, climate change adaptation, natural resource conservation, biodiversity conservation, and pollution prevention and control.

The following list of project categories, while indicative, captures the most commonly used types

of projects supported by or expected to

be supported by the Green Bond market. Green Projects include other related and supporting

expenditures such as R&D and may relate to more than one category and/or environmental objective.

Three environmental objectives identified above (pollution prevention and control, biodiversity

conservation and climate change adaptation) also serve as project categories in the list. As such,

they refer to the projects that are more specifically

designed to meet them.

The eligible Green Project categories, listed in no specific order, include, but are not limited to:

• renewable energy (including production, transmission, appliances and products);

• energy efficiency (such as in new and refurbished buildings, energy storage, district heating, smart grids, appliances and products);

• pollution prevention and control (including reduction of air emissions, greenhouse gas control, soil remediation, waste prevention, waste reduction, waste recycling and energy/emission- efficient waste to energy);

• environmentally sustainable management of living natural resources and land use (including environmentally sustainable agriculture; environmentally sustainable animal husbandry; climate smart farm inputs such as biological crop protection or drip-irrigation; environmentally sustainable fishery and aquaculture; environmentally-sustainable forestry, including afforestation or reforestation, and preservation or restoration of natural landscapes);

• terrestrial and aquatic biodiversity conservation (including the protection of coastal, marine and watershed environments);

• clean transportation (such as electric, hybrid, public, rail, non-motorised, multi-modal transportation, infrastructure for clean energy vehicles and reduction of harmful emissions);

• sustainable water and wastewater management (including sustainable infrastructure for clean and/or drinking water, wastewater treatment, sustainable urban drainage systems and river training and other forms of flooding mitigation);

• climate change adaptation (including information support systems, such as climate observation and early warning systems);

• eco-efficient and/or circular economy adapted products, production technologies and processes (such as development and introduction of environmentally sustainable products, with an eco-label or environmental certification, resource-efficient packaging and distribution);

• green buildings which meet regional, national or internationally recognised standards or certifications.

While the GBP’s purpose is not to take a position on which green technologies, standards, claims and declarations are optimal for environmentally sustainable benefits, it is noteworthy that there are several current international and national initiatives to produce taxonomies, as well as to provide mapping between them to ensure comparability. This may give further guidance to Green Bond issuers as to what may be considered green and eligible by investors. These taxonomies are currently at various stages of development. Issuers and other stakeholders can refer to examples through links listed on the Resource Centre at https://www.icmagroup.org/green-social- and-sustainability-bonds/resource-centre/).

Furthermore, there are many institutions that provide independent analysis, advice and guidance on the quality of different green solutions and environmental practices. Definitions of green and green projects may also vary depending on sector and geography.

2. Process for Project Evaluation and Selection

The issuer of a Green Bond should clearly communicate to investors:

• the environmental sustainability objectives;

• the process by which the issuer determines how the projects fit within the eligible Green Projects categories identified above;

• the related eligibility criteria, including, if applicable, exclusion criteria or any other process applied to identify and manage potentially material environmental and social risks associated with the projects.

Issuers are encouraged to position this information within the context of the issuer’s overarching objectives, strategy, policy and/or processes relating to environmental sustainability. Issuers are also encouraged to disclose any green standards or certifications referenced in project selection.

The GBP encourage a high level of transparency and recommend that an issuer’s process for project evaluation and selection be supplemented by an external review (see External Review section).

3. Management of Proceeds

The net proceeds of the Green Bond, or an amount equal to these net proceeds, should be credited to a sub-account, moved to a sub-portfolio or otherwise tracked by the issuer in an appropriate manner, and attested to by the issuer in a formal internal process linked to the issuer’s lending and investment operations for Green Projects.

So long as the Green Bond is outstanding, the balance of the tracked net proceeds should be periodically adjusted to match allocations to eligible Green Projects made during that period. The issuer should make known to investors the intended types of temporary placement for the balance of unallocated net proceeds.

The GBP encourage a high level of transparency and recommend that an issuer’s management of proceeds be supplemented by the use of an auditor, or other third party, to verify the internal tracking method and the allocation of funds from the Green Bond proceeds (see External Review section).

4. Reporting

Issuers should make, and keep, readily available up to date information on the use of proceeds to

be renewed annually until full allocation, and on a timely basis in case of material developments.

The

annual report should include a list of the projects to which Green Bond proceeds have been

allocated, as well as a brief description of the projects and

the amounts allocated, and their expected impact. Where confidentiality agreements, competitive

considerations, or a large number of underlying projects limit the amount of detail that can be

made available, the GBP recommend that information is presented in generic terms or on an

aggregated portfolio basis (e.g. percentage allocated to certain project categories).

Transparency is of particular value in communicating the expected impact of projects. The GBP recommend the use of qualitative performance indicators and, where feasible, quantitative performance measures (e.g. energy capacity, electricity generation, greenhouse gas emissions reduced/avoided, number of people provided with access to clean power, decrease in water use, reduction in the number of cars required, etc.), and disclosure of the key underlying methodology and/or assumptions used in the quantitative determination. Issuers with the ability to monitor achieved impacts are encouraged to include those in their regular reporting.

Voluntary guidelines aiming at a harmonized framework for impact reporting exist for energy efficiency, renewable energy, water and wastewater projects, and waste management projects (see guidance documents in the Resource Centre at https://www.icmagroup.org/green-social-and- sustainability-bonds/resource-centre/). The guidelines include templates for the format of impact reporting at a project and at a portfolio level that issuers can adapt to their own circumstances. The GBP encourage further initiatives, to help establish additional references for impact reporting that others can adopt and/or adapt to their needs. Guidelines for additional sectors are under development.

The use of a summary reflecting the main characteristics of a Green Bond or a Green Bond programme and illustrating its key features in alignment with the four core components of the GBP may help inform market participants. To that end, a template can be found on https://www.icmagroup. org/green-social-and-sustainability-bonds/ resource-centre/ which once completed can be made available online for market information (see section on Resource Centre below).

An issuer can seek advice from consultants and/or institutions with recognised expertise in environmental sustainability or other aspects of the issuance of a Green Bond. It may cover areas such as the establishment of an issuer’s Green Bond framework or the reporting of a Green Bond issuer. Consultancy or advisory services entail collaboration with the issuer and differ from independent external reviews. The GBP encourage independent review of environmental features of the (types of) assets or activities associated with the Green Bond or Green Bond programme, where applicable.

Independent external reviews may vary in scope and may address a Green Bond framework/programme, an individual Green Bond issue, the underlying assets and/or procedures. They are broadly grouped into the following types, with some providers offering more than one type of service, either separately or combined:

1. Second Party Opinion: An institution with environmental expertise, that is independent from the issuer may issue a Second Party Opinion. The institution should be independent from the issuer’s adviser for its Green Bond framework, or appropriate procedures, such as information barriers, will have been implemented within the institution to ensure the independence of the Second Party Opinion. It normally entails an assessment of the alignment with the Green Bond Principles. In particular, it can include an assessment of the issuer’s overarching objectives, strategy, policy and/or processes relating to environmental sustainability, and an evaluation of the environmental features of the type of projects intended for the Use of Proceeds.

2. Verification: An issuer can obtain independent verification against a designated set of criteria, typically pertaining to business processes and/ or environmental criteria. Verification may focus on alignment with internal or external standards or claims made by the issuer. Also, evaluation of the environmentally sustainable features of underlying assets may be termed verification and may reference external criteria. Assurance or attestation regarding an issuer’s internal tracking method for use of proceeds, allocation of funds from Green Bond proceeds, statement of environmental impact or alignment of reporting with the GBP, may also be termed verification.

3. Certification: An issuer can have its Green Bond or associated Green Bond framework or Use of Proceeds certified against a recognised external green standard or label. A standard or label defines specific criteria, and alignment with such criteria is normally tested by qualified, accredited third parties, which may verify consistency with the certification criteria.

4. Green Bond Scoring/Rating: An issuer can have its Green Bond, associated Green Bond framework or a key feature such as Use of Proceeds evaluated or assessed by qualified third parties, such as specialised research providers or rating agencies, according to an established scoring/rating methodology. The output may include a focus on environmental performance data, the process relative to the GBP, or another benchmark, such as a 2-degree climate change scenario. Such scoring/rating is distinct from credit ratings, which may nonetheless reflect material environmental risks.

An external review may be partial, covering only certain aspects of an issuer’s Green Bond or associated Green Bond framework or full, assessing alignment with all four core components of the GBP. The GBP take into account that the timing of an external review may depend on the nature of the review, and that publication of reviews can be constrained by business confidentiality requirements.

The GBP recommend public disclosure of external reviews as well as using the template for performed external reviews available on the Resource Centre at https://www.icmagroup.org/green-social-and- sustainability-bonds/resource-centre/. External reviewers are also encouraged to fill out the External Review Service Mapping Template which will be made available on the ICMA website.

The GBP encourage external review providers to disclose their credentials and relevant expertise

and communicate clearly the scope of the review(s) conducted. Voluntary Guidelines for External

Reviewers have been developed by the GBP to promote best practice. The Guidelines are a market-based initiative to provide information and

transparency on the external review processes for issuers, underwriters, investors, other

stakeholders

and external reviewers themselves.

Recommended templates and other GBP resources are available at the Resource Centre at https://www.icmagroup.org/green-social-and-sustainability- bonds/resource-centre/ Completed templates can be

made available online for market information at

the Resource Centre by following the instructions at the link above.

Disclaimer

The Green Bond Principles are voluntary process guidelines that neither constitute an offer to purchase or sell securities nor constitute specific advice of whatever form (tax, legal, environmental, accounting or regulatory) in respect of Green Bonds or any other securities. The Green Bond Principles do not create any rights in, or liability to, any person, public or private. Issuers adopt and implement the Green Bond Principles voluntarily and independently, without reliance on or recourse to the Green Bond Principles, and are solely responsible for the decision to issue Green Bonds. Underwriters of Green Bonds are not responsible if issuers do not comply with their commitments to Green Bonds and the use of the resulting net proceeds. If there is a conflict between any applicable laws, statutes and regulations and the guidelines set forth in the Green Bond Principles, the relevant local laws, statutes and regulations shall prevail.

There are currently four types of Green Bonds (additional types may emerge as the market develops and these will be incorporated in annual GBP updates):

• Standard Green Use of Proceeds Bond: a standard recourse-to-the-issuer debt obligation aligned with the GBP.

• Green Revenue Bond: a non-recourse-to-the- issuer debt obligation aligned with the GBP in which the credit exposure in the bond is to the pledged cash flows of the revenue streams, fees, taxes etc., and whose use of proceeds go to related or unrelated Green Project(s).

• Green Project Bond: a project bond for a single or multiple Green Project(s) for which the

investor has direct exposure to the risk of the project(s) with or without potential recourse to

the issuer,

and that is aligned with the GBP.

• Green Securitised Bond: a bond collateralised by one or more specific Green Project(s), including but not limited to covered bonds, ABS, MBS, and other structures; and aligned with the GBP. The first source of repayment is generally the cash flows of the assets.

It is recognised that there is a market of environmental, climate or otherwise themed bonds, in some cases referred to as “pure play”, issued by organisations that are mainly or entirely involved in environmentally sustainable activities, but that do not follow the four core components of the GBP. In such cases, investors will need to be informed accordingly and care should be taken to not imply GBP features by a Green Bond reference. These organisations are encouraged to adopt where possible the relevant best practice of the GBP (e.g. for reporting) for such existing environmental, climate or otherwise themed bonds, and to align future issues with the GBP.

It is also recognised that there is a market of sustainability themed bonds which finance a combination of green and social projects, including those linked to the Sustainable Development Goals (“SDGs”). In some cases, such bonds may be issued by organisations that are mainly or entirely involved in sustainable activities, but their bonds are not aligned to the four core components of the GBP. In such cases, investors will need to be informed accordingly and care should be taken to not imply GBP (or SBP) features by a Sustainability Bond or SDG reference. These issuing organisations are encouraged to adopt, where possible, the relevant best practice of the GBP and SBP (e.g. for reporting) for such existing sustainability, SDG or otherwise themed bonds, and to align future issues with the GBP and SBP.

A mapping of the GBP and SBP to the Sustainable Development Goals (SDGs) is available and aims to

provide a broad frame of reference by which issuers, investors and bond market participants can

evaluate the financing objectives of a given Green, Social or Sustainability Bond/Bond Programme against the SDGs. It can be found on the ICMA Website at

(https://www.icmagroup.org/green-social-and-sustainability-bonds/).

June 2019

Disclaimer: This document does not constitute an offer to purchase or sell securities nor constitute specific advice of whatever form (tax, legal, environmental, accounting or regulatory) and does not create any rights in, or liability to, any person, public or private. Issuers adopt and implement the mapping voluntarily and independently, without reliance on or recourse if there is a conflict between any applicable laws, statues and regulations and the guidelines the relevant local law, statues and regulations shall prevail.

Introduction

The Green Bonds Principles (GBP) are designed to promote the transparency and integrity needed to increase capital allocation to Green Projects. The capital markets are seeking greater clarity on how eligible Green Projects may contribute to environmental objectives, as well as their alignment with other green taxonomies, classifications and related environmental standards.

This document aims to provide a broad frame of reference by which issuers, investors, underwriters and other bond market participants can relate and evaluate the benefits and contribution of the GBP’s Green Project categories to the five environmental objectives referenced in the GBP (i.e. Climate Change Mitigation, Climate Change Adaptation, Natural Resource Conservation, Biodiversity Conservation, and Pollution Prevention and Control). It also provides a basis for comparison to other green taxonomies and classification systems currently used in the market.

The mapping complements the GBP in promoting green finance through the debt capital markets. The GBP do not promote any taxonomy or environmental standard but provide an indicative list of the most commonly used types of Green Project categories supported or expected to be supported by the green bond market.

While the GBP do not take a position on which green technologies, standards, claims or declarations are optimal for environmentally sustainable benefits, this is an effort to compare various approaches in the market. The document may be considered alongside other documents published in the Principles’ Resource Centre, particularly: Green and Social Bonds: A High-level Mapping to the Sustainable Development Goals as well as the Handbook on the Harmonized Framework for Impact Reporting and future guidance notes on impact reporting.

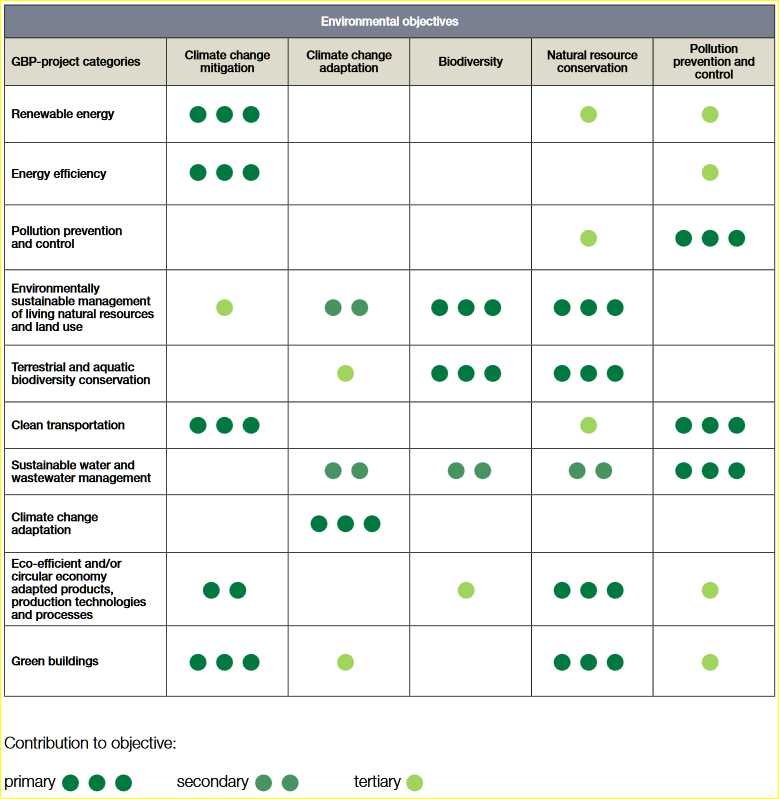

Table I (see below) provides a mapping of the contribution of Green Project categories to the aforementioned environmental objectives (Annex A) based on their most commonly observed contributions. The process for project evaluation and selection – under the second core component of the GBP - calls for an issuer of a Green Bond to communicate to investors the environmental sustainability objectives of their Green Project(s).

Such attributions are indicative only, as the relevant objectives and their relative contributions will be project specific. Furthermore, projects may also be deemed to contribute to various objectives not necessarily with a given priority among them.

The assessment is based on the issuer’s judgement. A common understanding of what qualifies as a Green Project and how it may contribute positively to environmental objectives may help investors, issuers and banks identify green assets across multiple jurisdictions, thereby enhancing market efficiency through redirecting capital flows to more sustainable investment opportunities.

Annex A

Table I: Mapping of the GBP-project categories to environmental objectives

Table II (see below) provides an indicative and high-level comparison across various classification systems of broad market use ( Annex B). It is based on the core green aspects and seeks to facilitate the comparison of various systems to each of the GBP project categories. The table shows how different classification systems may use different terminology or may focus on a particular attribute of the GBP’s project category. It does not determine project eligibility, nor relevant benchmarks, metrics or targets for each classification. Furthermore, a project’s classification may vary depending on sector and geography.

It is important to emphasize that these tables are meant to serve as reference, and that each project should be assessed on its distinct merits. Alignment with one or more of the other classification systems does not automatically ensure Green Project eligibility or alignment with the GBP. It is also important to note that relevant objectives and relative contributions are entirely project specific and may vary depending on geography. The GBP recommend that issuers seek an external review including an independent assessment of a Green Project’s eligibility.

green-project-categories and-various-classification-systems

Annex B

Table II: High level equivalence across classification standards

Please note that details and the current status of each of the taxonomies/classification referred to above can be found at the following links:

The China Green Bond Catalogue:

https://policy.asiapacificenergy.org/sites/default/files/Preparation-Instructions-on-Green-Bond-Endorsed-Project-Catalogue-2015-Edition-by-EY.pdf

CBI:

https://www.climatebonds.net/files/files/CBI-Taxomomy-Sep18.pdf

MDB-IDFC:

https://www.eib.org/attachments/documents/mdb_idfc_mitigation_common_principles_en.pdf

EU Taxonomy:

https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance_en

Source PDFs from:

Copyright © 2019 International Capital Market Association